Unlock Global Financial Flexibility with Our Banking Passport Program

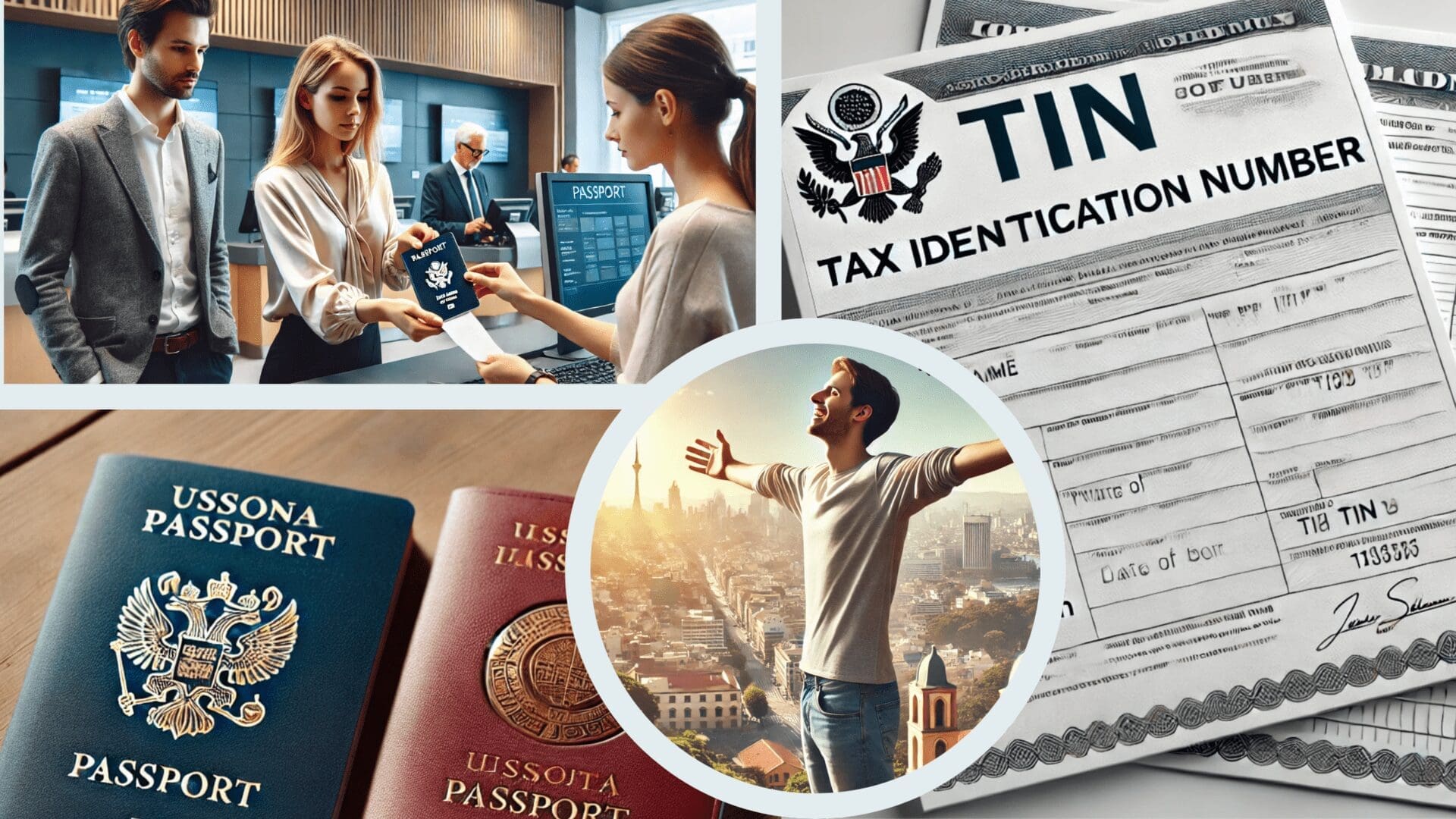

In an increasingly interconnected world, financial freedom and flexibility are essential. Amicus International Consulting proudly introduces the Banking Passport Program. This bespoke service grants unparalleled access to global banking opportunities. The program provides a second passport and a Tax Identification Number (TIN), enabling you to open bank accounts in any country.

Key Features of the Banking Passport Program

Second Passport Acquisition

Gain a second citizenship through our vetted government partners. Enjoy visa-free travel to numerous countries and enhance your global mobility and security.

Tax Identification Number (TIN)

A critical component of the Banking Passport Program is issuing a Tax Identification Number (TIN). This number is essential for managing financial activities globally. With a TIN, you can legally report and manage your income and financial transactions in compliance with international tax laws. Recognized by financial institutions worldwide, a TIN simplifies opening bank accounts and conducting financial operations across borders.

Global Banking Access

With your new TIN, you can open bank accounts in any country. This will allow you to diversify your financial portfolio through various banking services worldwide, including savings, investments, and loans.

Benefits of the Banking Passport Program

Enhanced Financial Privacy and Security

The Banking Passport Program offers numerous benefits beyond acquiring a second passport and a TIN. One of the primary advantages is the enhanced financial privacy and security it provides. By opening bank accounts in multiple countries, you can protect your assets from political and economic instability. This diversification significantly reduces the risk of frozen or seized assets due to local political upheaval.

Access to Enhanced Investment Opportunities

Another significant benefit is the access to enhanced investment opportunities. The Banking Passport Program opens up a world of investment options that may not be available in your home country. You can invest in diverse products and services with access to global financial markets.

Ease of Doing Business

Operating smoothly across borders is invaluable for entrepreneurs and business owners. The Banking Passport Program simplifies international transactions and business operations. With a second passport and TIN, you can open bank accounts and multiple currencies without complex and time-consuming procedures.

Tax Optimization

Tax optimization is another crucial benefit of the Banking Passport Program. Having a second passport and TIN provides opportunities to reduce tax burdens legally. You can choose to bank in countries with favourable tax laws, taking advantage of lower corporate tax rates, beneficial treaties, and other incentives offered by different jurisdictions.

Enhanced Emergency Preparedness

Ensuring a solid financial safety net during crises is paramount in an unpredictable world. The Banking Passport Program enhances the emergency preparedness necessary to confidently navigate political, economic, and personal upheavals.

Diversified Financial Resources

Acquiring a second passport and a (TIN) allows you to access international banking systems to open bank accounts anywhere. This setup offers a crucial layer of protection for your assets, ensuring they remain accessible and safe regardless of the situation in your home country. Whether facing political unrest, economic collapse, or personal emergencies, having diversified financial resources abroad ensures you can maintain liquidity and security.

Rapid Fund Transfers

One of the key benefits of the Banking Passport Program is the ability to quickly and efficiently move funds to and from different jurisdictions. In times of crisis, this flexibility can be lifesaving. For instance, if you find yourself in a country experiencing political turmoil or financial instability, the ability to transfer your assets to a more stable environment. This capability is especially critical in regions where governments may impose capital controls, freeze bank accounts, or confiscate assets during periods of instability.

Access to Stable Currencies and Secure Investments

Moreover, international banking options provide access to a broader range of financial services and products that may not be available in your home country. This includes access to more stable currencies, secure investment opportunities, and financial instruments that can help protect your wealth from devaluation and inflation. By diversifying your financial portfolio across multiple countries, you can mitigate the risks associated with relying solely on the monetary systems of a single nation.

Immediate Financial Access for Personal Emergencies

The Banking Passport Program also enhances your ability to respond to personal emergencies. Whether you need immediate access to funds for medical expenses, family emergencies, or other urgent needs, having bank accounts in different countries ensures you can obtain the necessary resources quickly and efficiently. This level of preparedness provides peace of mind, knowing that you have a robust financial support system, no matter where you are.

Streamlined Process and Expert Management

Furthermore, our team of experts streamlines and obtains a second passport and TIN through the Banking Passport Program. This means you can focus on your personal and professional priorities while we handle international financial regulations and compliance complexities. Our established relationships with government partners and financial institutions ensure the process is efficient and hassle-free, allowing you to benefit from enhanced emergency preparedness without the typical bureaucratic hurdles.

Long-Term Financial Stability

By ensuring your financial affairs are structured in multiple jurisdictions, you can plan for long-term stability. The Banking Passport Program offers immediate emergency solutions and strategies for enduring financial health. This proactive approach allows you to safeguard your wealth against future uncertainties, providing a legacy of security for you and your family.

Real-Life Examples of Emergency Preparedness

Case Study: Ahmed’s Emergency Preparedness

Ahmed, a prominent entrepreneur from Egypt, faced political instability in his home country. By participating in the Banking Passport Program, Ahmed acquired a second passport and TIN, which allowed him to open bank accounts in the United Kingdom and Canada. This provided him with a financial safety net, ensuring liquidity and security during times of crisis.

Case Study: Julia’s Quick Access to Funds

Julia, an investor from South Africa, wanted to ensure she had immediate emergency access to funds. Through the Banking Passport Program, she obtained a second passport and TIN, enabling her to open bank accounts in Germany and Australia. This access allowed Julia to manage personal emergencies efficiently and with confidence.

How the Program Works

Comprehensive Consultation and Assessment

The journey begins with a comprehensive consultation and assessment. Our experienced consultants engage with you to understand your specific needs and objectives. This personalized approach ensures tailored solutions.

Documentation and Processing

Next, we guide you through the documentation and processing phase, handling the bulk of the paperwork. Our established relationships with government partners ensure a streamlined and efficient process.

Issuance of Second Passport and TIN

Upon approval, you receive your second passport and TIN under a new financial identity. This milestone opens doors to new opportunities and greater financial flexibility.

Setting Up Global Banking Access

Finally, we assist in setting up global banking access. With your new TIN, you can open bank accounts in chosen countries, which are facilitated by our extensive network of international banking partners. We provide ongoing support to navigate international banking complexities.

Real-Life Success Stories

Case Study: Dmitry’s Financial Diversification

Dmitry, a tech entrepreneur from Russia, sought to diversify his assets and protect them from local economic uncertainties. Through the Banking Passport Program, he acquired a second passport and a TIN, allowing him to open bank accounts in Germany and Singapore. This strategic move provided Dmitry with greater financial security and access to more investment opportunities.

Case Study: Farah’s Asset Protection

Farah, a successful businesswoman from Iran, faced increasing economic instability and political risks in her home country. By participating in the Banking Passport Program, Farah obtained a second passport and a TIN, enabling her to open bank accounts in the United Arab Emirates and Switzerland. This provided Farah with a secure way to protect her assets from potential local economic disruptions.

Case Study: Ming’s Global Business Expansion

Ming, an ambitious entrepreneur from China, encountered significant barriers to international banking due to stringent regulations. Ming acquired a second passport and a TIN through the Banking Passport Program, allowing him to open bank accounts in Canada and the United Kingdom. This facilitated smoother business operations and transactions, helping Ming expand his business globally.

Case Study: Ahmed’s Emergency Preparedness

Ahmed, a prominent entrepreneur from Egypt, faced political instability in his home country. By participating in the Banking Passport Program, Ahmed acquired a second passport and TIN, allowing him to open UK bank accounts. This provided him with a financial safety net, ensuring liquidity and security during times of crisis.

Case Study: Julia’s International Investment Opportunities

Julia, an investor from South Africa, wanted to diversify her investment portfolio. Through the Banking Passport Program, she obtained a second passport and TIN, enabling her to open bank accounts in Germany. This access allowed Julia to invest in diverse financial products and mitigate risks associated with economic downturns in any region.

Take the Next Step Towards Financial Freedom

Embrace the possibilities of global financial flexibility. Contact Amicus International Consulting today to learn more about our Banking Passport Program and transform your financial future.

For more information or to schedule a consultation, visit our website or contact our offices directly. Let Amicus International Consulting be your partner in achieving global financial freedom.

If you would like to work with a professional team that can help make your transition to a life of freedom, contact Amicus Int. for New Identity services today.