An interview with the late Jack Webster about renouncing US citizenship and getting a new identity.

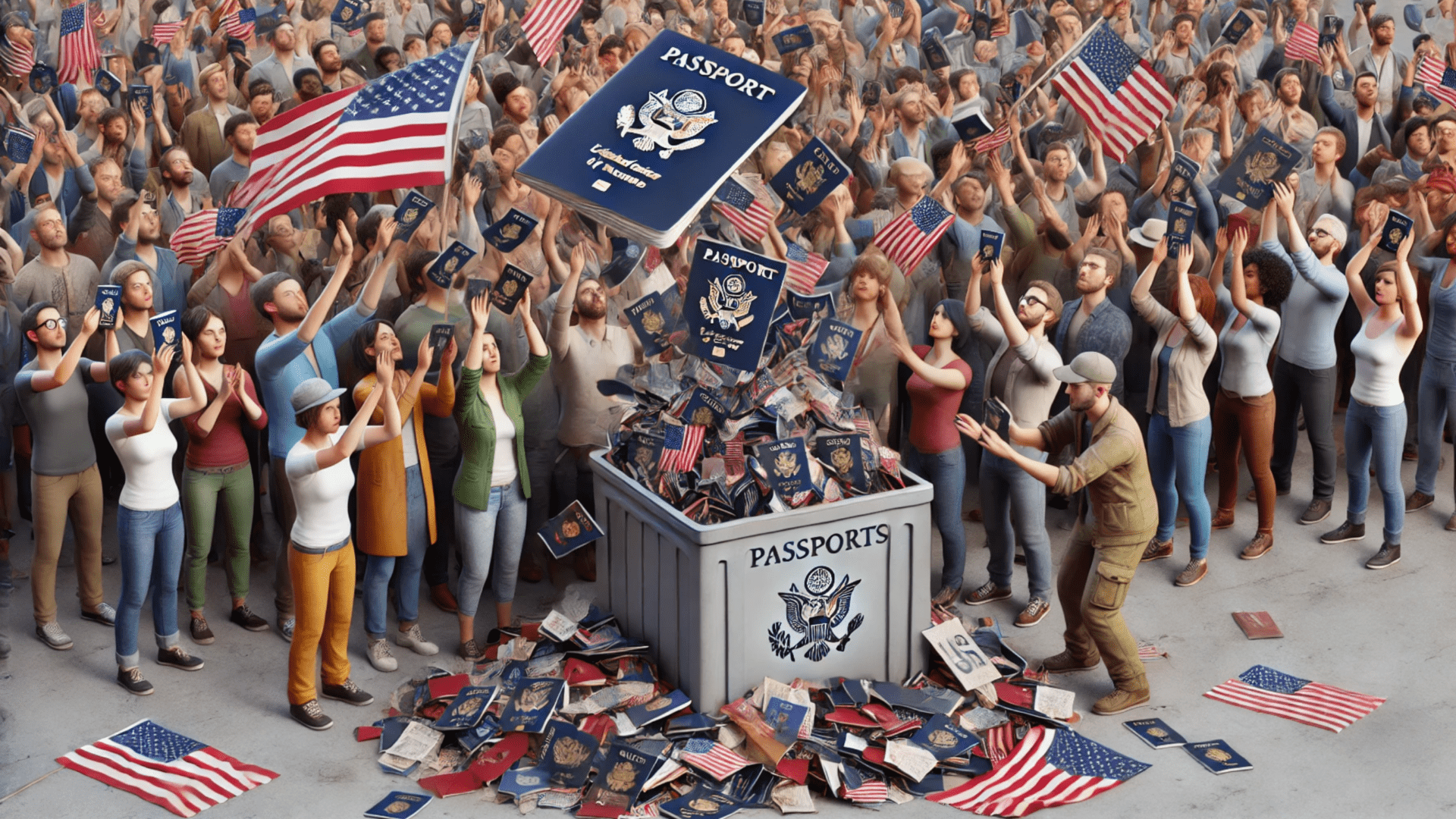

Jack Webster: In recent years, many Americans have renounced their citizenship. What is going on here?

Amicus Int.: Well, having a US passport used to be a tremendous advantage. But over the years, it has become an albatross around the necks of those who own one. America is the only major country that taxes its citizens no matter where they live.

Even if an American moves abroad, never returns, or even sets foot in the US again, he is obligated to file taxes and, at best, can get a $100,000 or so exemption on earned income. One way to ensure this does not happen is to acquire a new identity.

That makes it extremely costly to be an American. The US government also forces Americans to file many forms regarding their foreign financial dealings. They’re precluded from buying various assets or investing in multiple countries.

There are other disadvantages, too, because of the aggressive foreign policy stance that the United States has taken since World War II: invading numerous countries.

If a terrorist takes over an airplane or hotel, it’s unlikely that they are going to want to execute all the Mexicans or all the Latvians; chances are they want to single out people who carry US passports.

There are no longer any advantages or disadvantages to being an American. I say that recognizing that being born and raised in the US, at least up to now, has been a tremendous advantage.

But that has nothing to do with carrying a US passport. It’s a fortunate accident of birth because the US has historically been the most accessible country in the world, but that is changing.

Jack Webster: Even if Americans leave the US and never set foot in it again for the rest of their lives, the US government will still tax them. It’s the only country in the world with this tax system that can enforce it. Eritrea’s tiny, impoverished African nation also taxes its citizens this way. However, unlike the US government, it cannot implement it. So, it’s not a fair comparison.

What do you make of this?

Amicus Int.: That’s right. Of course, you can renounce your citizenship, but that is difficult.

It must be done outside the United States at a US embassy or consulate. The filing fee is $2,350; the forms generally take a year to process. Although the law has changed several times, there is now a penalty. All your worldwide assets are assessed, and you must pay a capital gains tax on the appreciation from whatever your cost basis is.

Jack Webster: Returning, we see that renunciation has become more complex and expensive for Americans. It used to be free. Then, the US government raised the fee to $450. They then increased it to $2,350.They also instituted the Exit tax on unrealized capital gains, making it increasingly costly. There are several proposals to make renunciation even more difficult in the years ahead. Perhaps one day, securing a new identity will also become impossible.

What is your take on this?

Amicus Int.: There is no question about it. A couple of years ago, they passed a regulation that if you were accused of not being adjudicated but accused of owing over $50,000 to the US government, your passport could be taken from you. That happened to over 300,000 Americans last year.

I know that for a fact because I know somebody this happened to. Also, it’s tough for an American to open a financial, bank, or brokerage account in almost any other country.

Financial institutions don’t want American business because the US dollar is the world’s currency, and the US can enforce domestic laws on foreign countries. A foreign bank or broker has to report transactions of its US clients. Nobody wants a US client for that reason. There are unprofitable liabilities.

Jack Webster: Bankrupt governments always try to control money with capital controls and individuals with people controls.

Take Cuba, for example. After Castro came to power, his government required Cuban citizens to apply for exit visas before they left the island. These visas were not easy to get. The Soviet Union and North Korea have also used similar restrictions.

Preventing people from leaving has always been a hallmark of authoritarianism. It’s hardly shocking that productive people are fleeing the US tax system. It is also clear the window to leave is closing. What does all this signal for the future of the United States?

Amicus Int.: The US is on the way to becoming an actual police state. The US government is bankrupt, and the situation is getting worse every year, with minimum annual deficits of a trillion dollars going to two trillion dollars.

The prime directive of any living thing, whether it’s an amoeba, a person, a corporation, or a government, is to survive. And to survive, the US government needs more tax revenues. It will make more efforts to keep its milk cows from leaving the country and escaping its tax net.

I do not doubt that the US is behind the various UN efforts to harmonize the world’s tax system, so there’s no place you can run. And if they move to a completely digital currency, it will be almost impossible to evade their grasp at that point. Using digital national currencies and eliminating physical cash, they know precisely how much you earn, spend, and have. The trend is terrible.

The US government, however, is unique in being able to enforce its will almost anywhere in the world. If you leave a European, Asian, or South American country, there is nothing your country can do about it. But the US has become a global empire they are trying to hold together by force. This makes it imperative to have a new identity for just-in-case scenarios.

Meanwhile, it is in the process of flying apart through centrifugal force. I don’t doubt that within the next 50 years, probably much less, the US will break up into autonomous regions or even separate countries. The Hispanic Southwest is undoubtedly going to be one of them. Neil Stephensons’ book Diamond Age outlines some possibilities. Having a passport with a new identity is essential before you Renounce your US citizenship.

Every day the US Congress is in session, new laws are passed, and every law they pass imposes something else you must or must not do. Enforcing that law takes more tax revenue. So, of course, the beast will get bigger and uglier as time passes until it collapses. But that will bring on chaos for at least a while, which is unpleasant and dangerous.

Jack Webster: Given our discussion, what do you suggest people do?

Amicus Int.: Your options are becoming more limited all the time. You could renounce your citizenship, but for convenience, you need a second citizenship with a new identity. Everybody needs a slave card in today’s world.

I think it’s prudent for anybody, not just Americans, to have a second or third citizenship as a backup because your passport is not your property; it is the property of your government, and they can take it away from you. You will want to have at least one backup with a new identity. That’s number one.

Number two, you will want to diversify your assets to another political jurisdiction while it is still possible. The best way to do this is to buy real estate in a place you like to spend time in and have gold or other financial assets put aside in that country or a third country. But act now and beat the last-minute rush. There are no disadvantages and lots of advantages to doing these things.

Editors Note: The political and economic climate is constantly changing and not always for the better. Obtaining the political diversification benefits of a second passport is crucial to ensuring you won’t fall victim to a desperate government and enabling you to renounce your US citizenship.