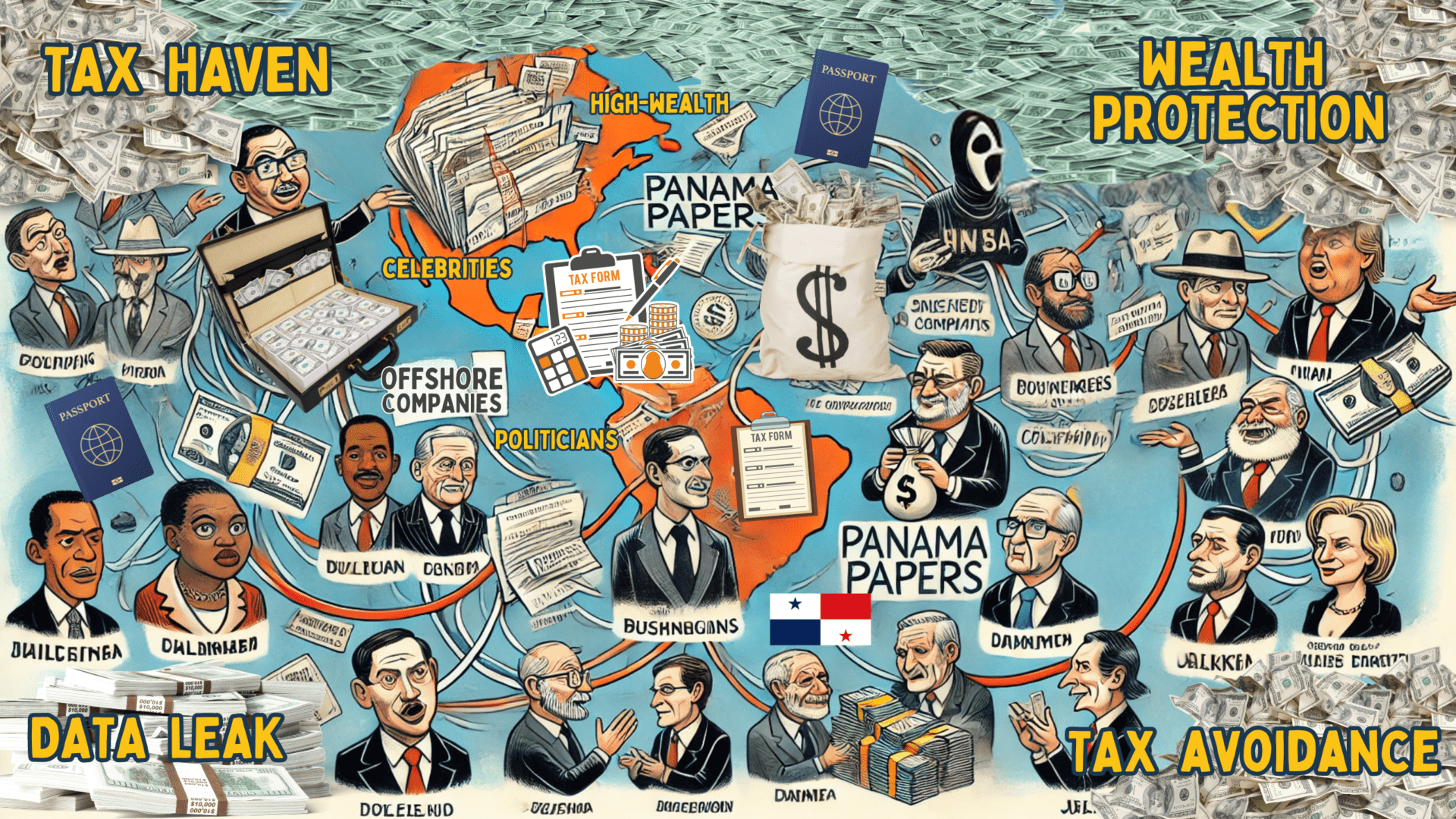

What Are the Panama Papers?

The Panama Papers refer to a massive leak of 11.5 million encrypted confidential documents from Mossack Fonseca, a Panama-based law firm. An anonymous source leaked these documents to the German newspaper Süddeutsche Zeitung (SZ), and they were made public on April 3, 2016.

Scope of the Leak

The documents exposed a network of over 214,000 tax havens involving wealthy individuals, public officials, and entities from 200 nations. With a total volume of about 2.6 terabytes, the Panama Papers represent the most significant data leak in history.

Content of the Documents

While many documents showed no illegal actions, some shell corporations set up by Mossack Fonseca facilitated fraud, tax evasion, or the evasion of international sanctions.

Key Figures and Entities Involved

The leak revealed the involvement of 140 politicians from various countries, alongside celebrities, drug dealers, alleged arms traffickers, and members of the global elite.

Significance of the Leak

The Panama Papers provided an unprecedented look into the secretive offshore finance industry. They showed how the global elite used hard-to-trace companies and tax havens to hide their wealth and questionable business deals.

Media and Investigative Collaboration

The Panama Papers investigation was one of the most significant collaborations of journalists in history, involving more than 350 reporters from 80 countries. The International Consortium of Investigative Journalists (ICIJ) coordinated the investigation.

Immediate Reactions and Impact

The revelations led to protests in several countries and resulted in high-profile resignations, including Iceland’s Prime Minister Sigmundur David Gunnlaugsson. Authorities launched numerous tax probes and criminal investigations worldwide, leading to policy changes to combat offshore tax evasion.

The Significance of the Leak

The Panama Papers are one of the most impactful data leaks in history. By exposing the inner workings of Mossack Fonseca, the leak highlighted how the global elite exploits tax havens to conceal their wealth and engage in dubious business practices.

Exposure of High-Profile Figures

The documents implicated 140 politicians from around the world, alongside celebrities, drug dealers, alleged arms traffickers, and influential figures. These individuals used complex networks of shell companies and offshore accounts to hide their assets, evade taxes, and bypass international sanctions. The scale and audacity of these operations captured global attention, igniting widespread outrage and demands for accountability.

Political Fallout and Public Protests

The immediate fallout from the Panama Papers was dramatic. In Iceland, public protests erupted, culminating in Prime Minister Sigmundur David Gunnlaugsson’s resignation. Political upheavals were witnessed in other countries, where implicated officials faced intense scrutiny and calls for removal.

Criminal Investigations and Legal Actions

Following the Panama Papers leak, authorities worldwide initiated numerous criminal investigations and legal actions against individuals and entities implicated in the documents. These investigations aimed to uncover illicit financial activities, recover unpaid taxes, and hold responsible parties accountable for their actions.

Case Study 1: Keith Schembri, Malta

Keith Schembri, the former chief of staff to the Maltese Prime Minister, faced money laundering and fraud charges. His involvement in the scandal highlighted the pervasive nature of corruption and the use of offshore entities to launder money. Schembri’s trial shed light on the intricate methods used to hide illicit funds and evade taxes, leading to broader calls for financial transparency and accountability in Malta.

Case Study 2: Nawaz Sharif, Pakistan

In Pakistan, the Panama Papers directly impacted the political landscape. The documents revealed undisclosed assets linked to then-Prime Minister Nawaz Sharif and his family. The Supreme Court of Pakistan disqualified Sharif from office, citing his failure to be “honest” and “truthful.” This decision was a landmark moment in Pakistani politics, emphasizing the judiciary’s role in holding influential individuals accountable and prompting further investigations into Sharif’s financial dealings.

Case Study 3: Operation Car Wash, Brazil

In Brazil, the Panama Papers became part of the broader Operation Car Wash, an extensive anti-corruption probe. The documents revealed connections between Mossack Fonseca and several Brazilian politicians and business leaders involved in bribery and money laundering schemes. The investigations led to multiple arrests and convictions, including high-profile figures such as former President Luiz Inácio Lula da Silva. The revelations reinforced the importance of transparency and accountability in combating systemic corruption.

Case Study 4: Sigmundur David Gunnlaugsson, Iceland

In Iceland, the leak revealed that Prime Minister Sigmundur David Gunnlaugsson and his wife owned an offshore company with significant claims on Icelandic banks. This revelation sparked massive public protests, leading to Gunnlaugsson’s resignation. The case underscored the power of public pressure in demanding accountability from political leaders and highlighted the impact of offshore finance on national politics.

Case Study 5: Lionel Messi, Argentina

Argentine football star Lionel Messi was also implicated in the Panama Papers. The documents showed that Messi and his father owned an offshore company used to manage his image rights. Spanish authorities investigated the case, and Messi was found guilty of tax fraud. He received a 21-month suspended prison sentence and was ordered to pay a substantial fine. The case illustrated the widespread use of offshore entities to evade taxes, even among high-profile celebrities.

Financial Impact and Asset Recovery

Governments leveraged the information to recover or seize tens of millions of dollars in unpaid taxes and assets. This highlighted the fiscal losses from offshore tax evasion and underscored the potential for substantial recoveries when hidden wealth is brought to light.

Policy Changes and Legislative Reforms

The revelations spurred substantial policy changes and legislative reforms. Countries introduced stricter regulations to combat offshore tax evasion and improve financial transparency. In the United States, lawmakers cited the Panama Papers to bolster support for critical legislative initiatives aimed at curbing the use of tax havens and enhancing accountability.

Increased Public Awareness and Debate

The Panama Papers profoundly influenced public awareness and discourse around the ethics and implications of offshore finance. The leak sparked global debates on corruption, financial crime, and inequality, becoming a touchstone for discussions on the need for greater transparency and regulation in the financial sector.

Impact on Journalism

The investigation, coordinated by the ICIJ, involved over 350 reporters from 80 countries, setting a new standard for collaborative journalism. This unprecedented effort demonstrated the power of investigative journalism in uncovering hidden truths and inspired a new wave of journalists to adopt similar methodologies.

The Role of Tax Havens in Global Finance

Tax havens are jurisdictions with very low or non-existent taxes, often characterized by solid secrecy laws. They make it challenging for foreign tax authorities to track the income or wealth held by their citizens in these places.

The Scale and Impact of Tax Havens

Tax havens collectively cost governments between $500 billion and $600 billion annually in lost corporate tax revenue. Individuals have stashed approximately $8.7 trillion in these jurisdictions, with some estimates reaching up to $36 trillion. The impact of lost revenue is more significant on low-income economies, which rely heavily on foreign development assistance.

Inequality and Economic Impact

Large financial institutions and multinationals primarily use tax havens, creating an uneven playing field against small and medium enterprises. This system promotes monopolization and tilts economic power towards the elite, exacerbating inequality.

Political and Financial Stability Challenges

Tax havens offer hiding places for the illicit activities of the powerful elite, which harms the less powerful majority. Allowing free capital flow across borders poses risks, including financial instability in emerging market economies.

Regulatory Response and Future Outlook

The Panama Papers and other leaks have illuminated the scale and functioning of tax havens, leading to calls for improved regulation and transparency. These efforts aim to address the challenges posed by tax havens and promote a fairer global financial system.

The Amicus International Banking Passport Program

Privacy and Wealth Protection

In an ever-changing world with constantly evolving financial regulations and transparency measures, the need for extreme privacy and protection of one’s wealth has never been greater. Amicus International Consulting offers a unique solution through its Banking Passport Program. This program provides individuals with a new legal identity, ensuring their financial privacy and security.

How the Program Works

The Banking Passport Program is designed for individuals seeking confidentiality in their financial affairs. By obtaining a new legal identity, participants can navigate the complexities of global finance with enhanced privacy. This program mainly benefits those looking to protect their assets from potential threats and regulatory changes.

Benefits of the Banking Passport Program

- Extreme Privacy: The program ensures that personal and financial information remains confidential, safeguarding against prying eyes and unauthorized access.

- Legal Identity: Participants receive a new legal identity, providing an additional layer of security and anonymity.

- Asset Protection: The program helps protect wealth from potential risks such as political instability, economic downturns, and legal challenges.

- Global Financial Access: With a new legal identity, participants can access banking services and investment opportunities in jurisdictions worldwide, free from restrictive regulations.

Tailored Solutions for Wealth Management

Amicus International Consulting’s Banking Passport Program offers a bespoke approach to wealth management. Each participant’s unique needs and circumstances are considered to provide tailored solutions that ensure maximum privacy and protection.

Why Choose Amicus International Consulting?

- Expertise: With years of experience in the financial sector, Amicus International Consulting has the knowledge and expertise to navigate complex financial landscapes.

- Trustworthiness: The firm is committed to providing reliable and secure services, earning clients’ trust worldwide.

- Innovation: Amicus International Consulting continuously innovates to offer cutting-edge solutions that meet clients’ evolving needs.

Conclusion

The Panama Papers revealed the extensive use of offshore finance to hide wealth and conduct questionable business dealings. The leak has had far-reaching consequences, prompting political fallout, criminal investigations, asset recovery, policy changes, and increased public awareness. As we continue to understand the impact of tax havens and offshore finance, we must push for improved regulation and transparency to create a more equitable global financial system.

Amicus International Consulting’s Banking Passport Program offers a viable solution for those seeking extreme privacy and wealth protection. The program ensures confidentiality and security in an ever-changing world by providing a new legal identity.

Stay tuned to Amicus International Consulting’s blog for more insights into tax havens, offshore finance, and innovative financial solutions. We are committed to providing in-depth analysis and updates on these critical issues.

If you would like to work with a professional team that can help make your transition to a life of freedom, contact Amicus Int. for New Identity services today.